california nanny tax rules

The nanny tax rules apply to you only if 1 you pay someone for household work and 2 that worker is your employee. Like other employers parents must pay certain taxes.

Fortunately securing workers comp insurance for your nanny should be relatively easy.

. You could be subject to an underpayment penalty if you wait until you file your tax return in April and it turns out that you owe a nanny tax balance because you didnt pay. Because your nanny will be working full-time she will be covered under workers comp. If youre a nanny you might want to pay your nanny tax in quarterly estimated payments as the year progresses or ask your own employer to increase your withholding to cover these additional taxes.

Parents that hire babysitters for their children are also required to pay the nanny tax if compensation exceeds the 2100 wage threshold per year for any one sitter. Instead of withholding the nannys share from the wages parents may choose to pay the nannys share themselves. Nanny Tax Example.

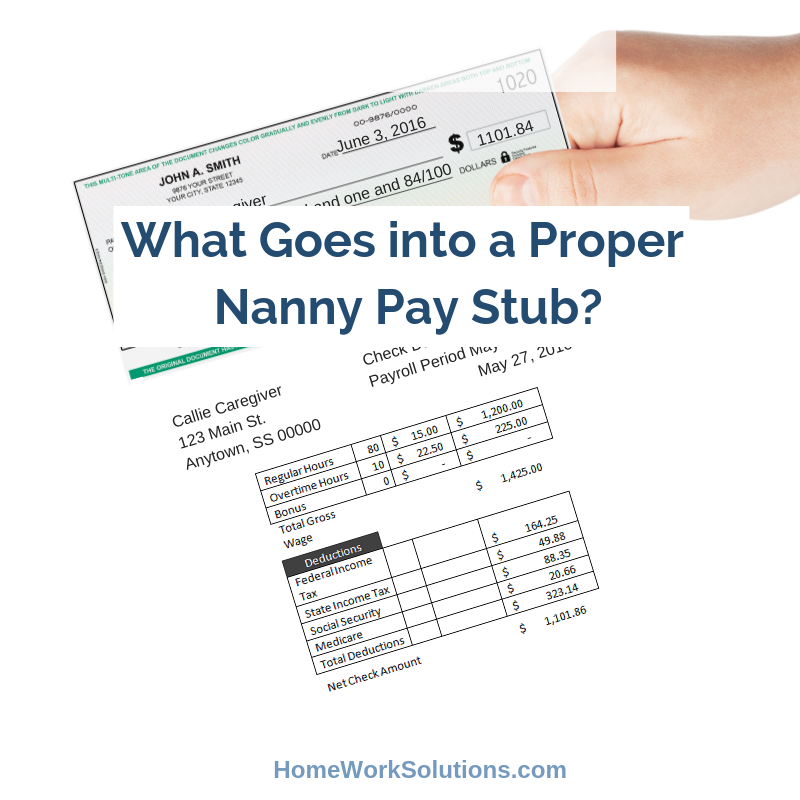

Remember nannies are required to be paid by the hour and cant be paid a salary. Stay legal when you create that nanny paycheck. They also receive overtime pay for the first eight hours worked on the seventh consecutive day of the work week.

If you pay a household employee such as a nanny babysitter caregiver or house manager more than 2400 a year or 1000 in a quarter to perform work in your home or occasionally even out of your home such as in a nanny share you are a household employer. The UI maximum weekly benefit amount is 450. Since they do not fall under any of the exemption categories the individual is required to follow the regulations of the nanny tax.

Youll withhold 3825 for FICA from their pay. California Nanny Tax Rules The fica tax is a total of 153 124 for social security and an additional 29 for medicare. You are not required to register report employee wages or withholdpay any California payroll taxes because the cash wage limit of 750 in a quarter has not been met the value of meals and lodging is not included in reaching the 750 cash wage limit.

Californias Minimum wage for 2018 is 1050hour if you employ 1-25 employees. Nest Payroll takes care of the nanny tax here is the checklist you need when you hire a nanny caregiver housekeeper gardener or anyone that works in your home. When your kids are in school full-time you decide to part ways with your nanny since their services are no longer needed.

At that same rate of pay your nanny will make 4500 in the quarter. For purposes of workers comp household workers arent considered employees if they worked less 52 hours or earned no more than 100 in the 90-day period before the injury. Get a free no-obligation consultation with a household.

One of the best things about being a nanny for a nanny share is that nannies typically make more money working for two families than they would for one. Your nanny works for you for several years without having taxes withheld or you paying taxes on their wages. Their take-home pay is 46175.

While federal laws cover employers in all states there are also state- and city-specific regulations that employers must follow. 2022 Payroll Tax Rates Taxable Wage Limits and Maximum Benefit Amounts. Have your employee complete this form which dictates how California income tax.

Firstly to calculate the tax multiply 40000 by 765. In 2021 for cash wages of 2300 or more per employee social security and Medicare. Your nanny files for unemployment benefits and is required to list you as their past employer.

Examples of household employees include babysitters nannies health aides private nurses maids caretakers yard workers and similar domestic workers. And because most families use a nanny payroll service handling net gross and direct deposit is all accounted for. Unemployment Insurance UI The 2022 taxable wage limit is 7000 per employee.

First employers must pay at least minimum wage for all time worked. A nanny tax is a federal tax paid by people who employ household employees and pay wages over a certain amount. The UI tax rate for new employers is 34 percent 034 for a period of two to three years.

Families even the most well. Same rules apply for a nanny share. A household employee is someone who does work in or around your home.

Your nanny works 40 hoursweek at 1250hour making their gross pay 500week. FUTA tax is normally applied at a rate of 06 percent of wages2 Besides these Federal taxes a household employer is generally required to remit certain State payroll taxes. Assuming your nanny is a personal attendant.

However counties and cities may have higher minimum wages. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes. Youll also contribute 3825 for FICA.

Tered under the Federal Unemployment Tax Act FUTA when they pay their employees more than 1000 in any quarter of the current or preceding calendar years. Cash wages include both checks and cash. Employing a nanny means complying with federal and state labor laws regarding wages.

Need help with the legalese around nanny taxes. Therefore the FICA tax will be 3060 from their wages and the employer must add an additional 3060. Household employers must report when they employ one or more individuals to perform work and pay cash wages of 750 or more in a calendar quarter.

If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H. Employers of household workers can offer benefits such as parking public transportation college tuition and health insurance as non-taxable compensation. That exceeds the FUTA exemption limit.

To claim the credit the qualifying child must be under age 13 and. Double time kicks in for hours worked over 12 in a day and over eight hours on the seventh consecutive day of the work week. Nanny tax calculator for a nanny share.

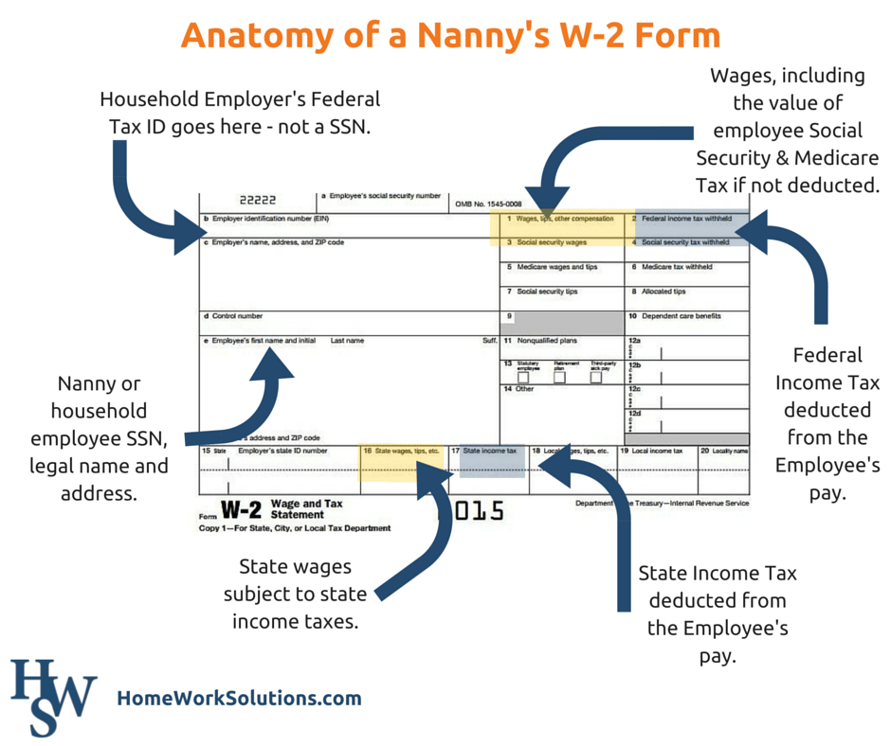

Copy A along with Form W-3 goes to the Social Security Administration. Make sure you have workers compensation have a nanny contract pay overtime minimum wage know labor laws in California. Nanny Taxes in California Household employers need to comply with tax wage and labor laws that affect nannies in-home senior caregivers and other household employees.

Do not include noncash wages such as meals and lodging when calculating whether you have reached 750 in cash wages.

.png?width=800&name=2017%20W-2%20FORM%20(2).png)

W 2 Reporting Required For Nanny Tax Free Healthcare Benefits

California Durable Power Of Attorney Form Power Of Attorney Form Power Of Attorney Being A Landlord

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)

Is It Ok To Pay My Nanny In Cash

California Nanny Tax Rules Poppins Payroll

The Temporary Nanny And Her Taxes

California Nanny Tax Rules Poppins Payroll

The Right Time To Put A Nanny Or Caregiver On The Books Hws

Nanny Payroll Part 3 Unemployment Taxes

The Basics Of Household Payroll Nanny Taxes Tax Practice Advisor

Can I Deduct Nanny Expenses On My Tax Return Taxhub

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

How Does A Nanny File Taxes As An Independent Contractor

What Goes Into A Proper Nanny Pay Stub

Mother Showing Media Content Nanny Tax Nanny Services Nanny

A Nanny Asks Questions About Form W 2

It Happens You Lost Your Job And Your Financial Situation Just Changed Dramatically First Start With Having An Open And Honest Co Nanny Tax Nanny Losing You